Corporate Philosophy, etc.

The JASDEC Group (Japan Securities Depository Center, Inc., and JASDEC DVP Clearing Corporation) has formulated a corporate philosophy that expresses our fundamental approach to corporate activity within our organization and forms the basis for management planning and business execution by all directors and employees. Related policies established by the Group include a Basic Management Policy, a Basic Policy on Corporate Governance.

Corporate Philosophy

Recognizing our public role as a provider of important settlement service in the capital market, we aim to provide reliable, convenient and highly efficient services that help improve capital market functions and contribute to the development of society.

Accordingly, we will strive to stay closely attuned to business environment and structural changes in the domestic and international capital markets, and undertake constant reform to improve services from the point of view of investors, issuers, market intermediaries and other market participants.

Basic Management Policy

-

1Undertake user-oriented operational management as well as emphasize corporate governance, from the point of view of investors, issuers, market intermediaries and other market participants.

-

2Keep business environment and structural changes in the capital market firmly in mind and provide globally recognized best practice in settlement services at a moderate price, by acting rapidly and flexibly to improve and reform operations as well as reducing cost and enriching financial resources.

-

3Ensure continuous and stable operational management, such as creating a corporate culture that emphasizes risk management, from the standpoint of concentrating operations in settlement infrastructure while expanding the scope of services.

-

4Recognize the public nature of our operations and ensure active disclosure and management transparency.

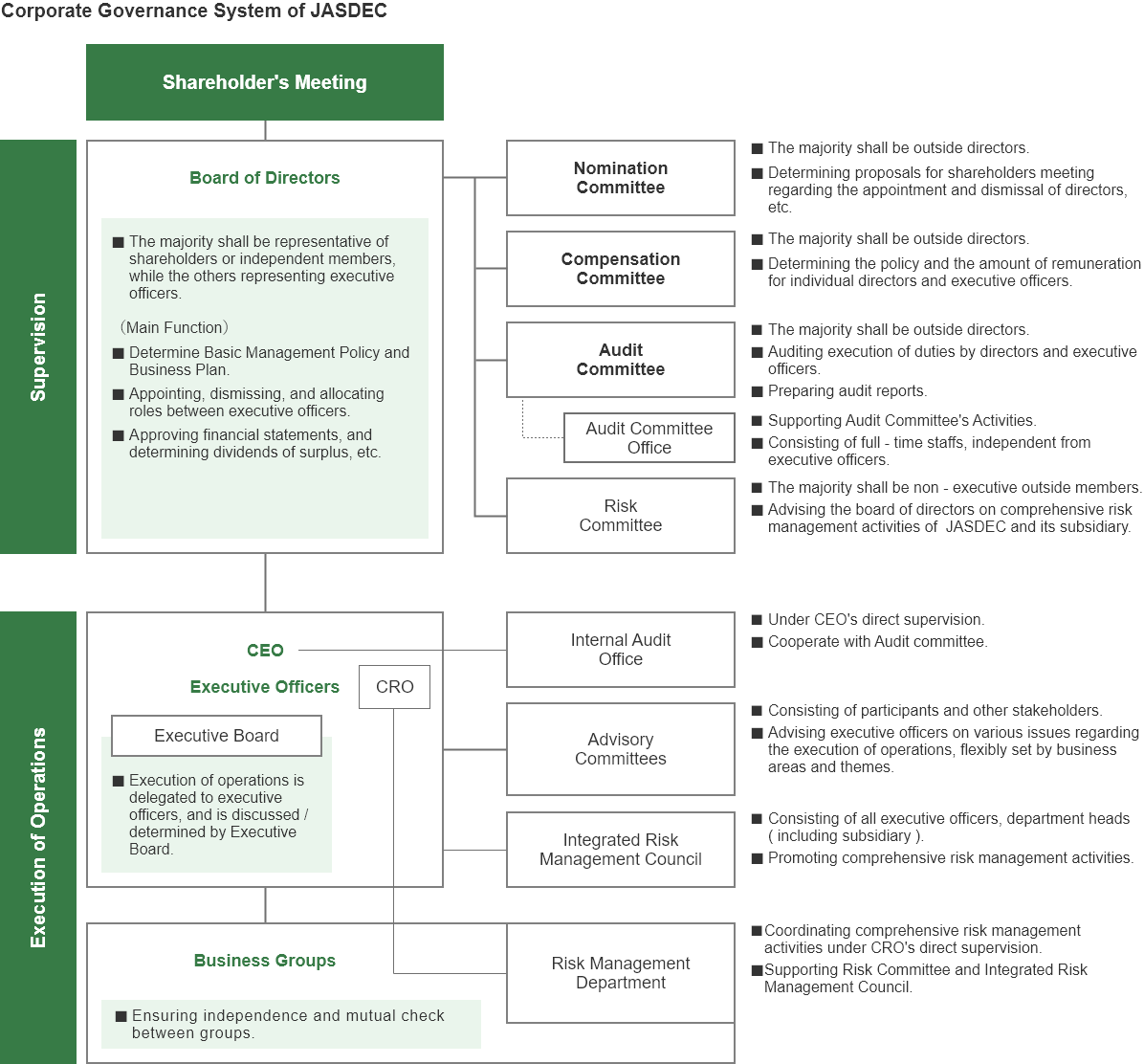

Basic Policy on Corporate Governance

Symbol

- DESIGN

- The symbol represents the people-to-people or informational "connection", and the asymmetrical shape emphasizes a more human and warm "connection" rather than a mechanical connection. In addition, the three circles represent investors (individual investors, institutional investors, etc.), issuers (business companies, etc.), market intermediaries (securities companies, banks, asset management companies, etc.) that support Japan's financial and capital markets together with us.

- COLORS

- The colors of the symbol, green and blue, are images of the ground and the sea, in other words, those of the earth, and express the desire to support sustainable growth.