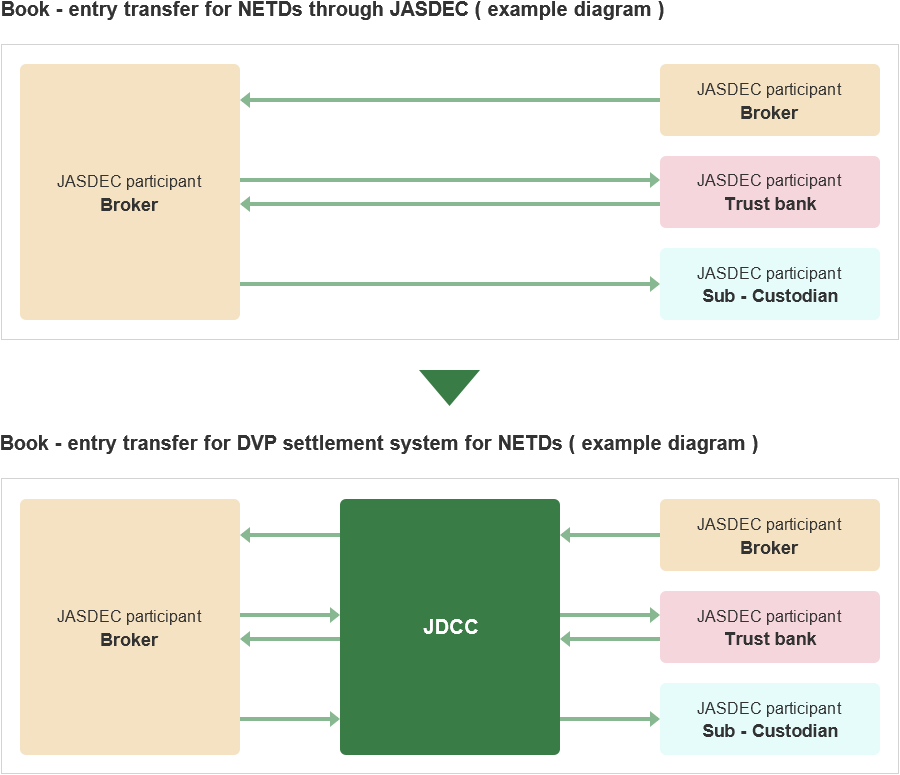

Framework of DVP settlement system for NETDs

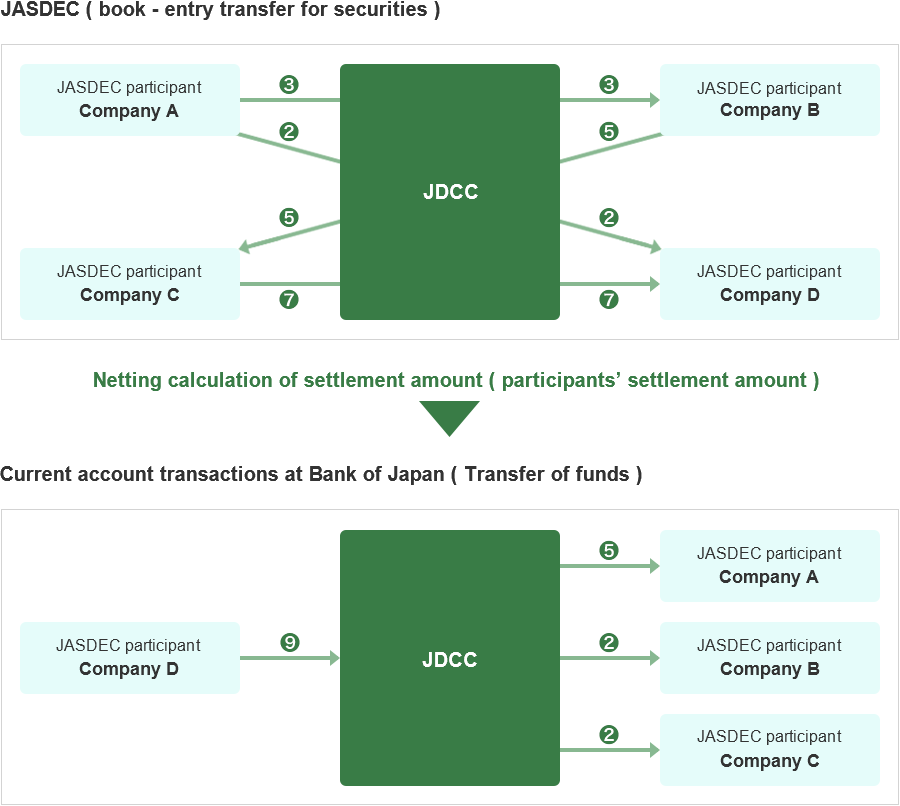

In the DVP settlement system for NETDs , JDCC assumes the obligations between two DVP participants (that of transferring the securities to one counterparty and that of paying the settlement amount to the other counterparty) and simultaneously acquires the claims which are equivalent to the obligations. As a result, whenever DVP participants make use of the DVP settlement system, all counterparty of all transactions can be consolidated into one: the JDCC

Furthermore, in the DVP settlement system for NETDs , the delivery of securities can be carried out on transaction by transaction basis (gross base) at any time during the day, in the other side , the payment of settlement amount can be carryied out on the netted amount (net base) after the completion of the delivery of securities. This type of DVP scheme is referred to as 'Gross = Net-type' DVP.

For enquiries about the DVP settlement system for NETDs please contact:

General Enquiries about the DVP Settlement System for NETDs