Outline of Transactions

(1) Domestic Transactions

1.Scope of Services (Ref. Fig. 4)

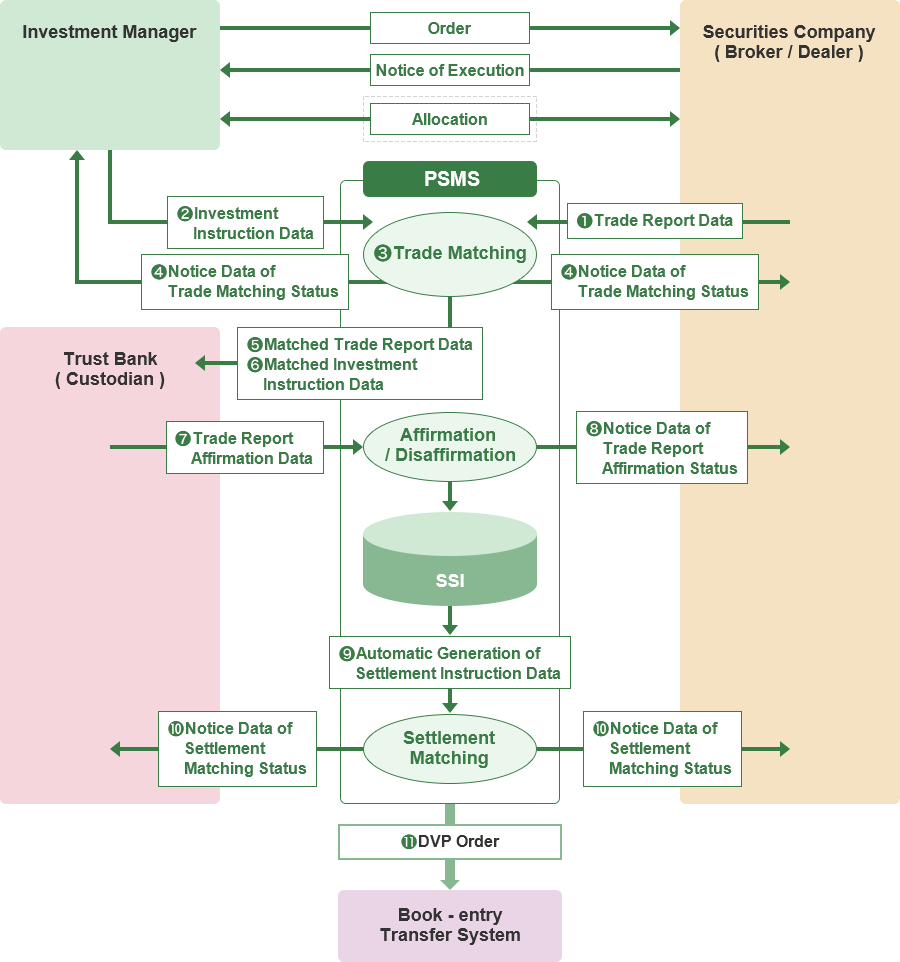

Fig. 4 Domestic Transactions - Tripartite Central Matching Type (Without Using Investment Instruction Distribution Service)

As to Order, which is the starting point of the trade, and Notice of Execution (NOE), various services are provided in accordance with the market participants' needs, since these are the origin of competition for those in the market. And, as to Allocation after the NOE, it was not permitted in Japan to report trades by average price, and was difficult to have the process of allocation in common when PSMS originally started. Therefore, PSMS have not covered the allocation but the processes followed, starting from the transmission of Trade Report Data by securities companies and Investment Instruction Data by investment managers. After the transmission of Trade Report Data and Investment Instruction Data, PSMS performs trade matching procedure as stated below and finally performs matching and fixing Settlement Instruction Data. The Settlement Instruction Data matched and fixed in PSMS is automatically transmitted to the Book-entry Transfer Systems, and finally, the DVP settlement is completed.

2.Outline of Matching Process

PSMS is developed to perform the post-trade matching procedure mainly for institutional investors' transactions, so it covers two the transaction types. One is a type like specified money trust that the buy-side consists of investment managers(investment trust management companies/investment advisory companies) and trust banks. And another is a type, so called Proper type, that the buy-side consists of a single entity such as life/non-life insurance companies and trust banks which perform matching for their own transactions. Further, the former type can be categorized into four types, by the difference of the data transmission method between the investment managers and the trust banks and of the trade matching process, as Tripartite Central Matching Type (Without Using Investment Instruction Distribution Service), Tripartite Central Matching Type (Using Investment Instruction Distribution Service), Through Type and Investment Instruction Support Unsubscribed Type. Added to these types for institutional investors' transactions, PSMS provides two more transaction types; Bilateral Central Matching Type which is prepared to confirm the trade report of OTC transactions like inter-broker trades, and Duplex Type which is used to confirm the new issuing record information of shares. The matching process for Tripartite Central Matching Type (Without Using Investment Instruction Distribution Service) is described below as a major case for institutional investors' transactions:

-

1

Transmission of Trade Report Data and Investment Instruction Data (Fig. 4 ①②)

As stated above, Order from investment managers to securities companies, Notice of Execution from securities companies to investment managers, and Allocation between investment managers and securities companies are out of the scope of services, the service starts from the transmission of Trade Report Data from securities companies and Investment Instruction Data from investment managers. -

2

Matching of Trade Report Data and Investment Instruction Data (Trade Matching) (Fig.4 ③)

When Trade Report Data/Investment Instruction Data are received, PSMS searches for the data to be matched in accordance with the matching logic. When the data to be matched are specified, the matching procedure of trade details takes place and PSMS will transmit Notice Data of Trade Matching Status to the investment manager and securities company (originators of matching data) in the real-time, together with the status information of "Matched" or "Unmatched". (Fig. 4 ④) In case of "Unmatched", the reason of discrepancy and details of counterpart for unmatched item will be transmitted. -

3

Transmission of Trade Report Data and Investment Instruction Data to Trust Banks and Trade Report Affirmation Data (Fig. 4 ⑤⑥⑦⑧)

When the data is matched mentioned above item 2, Trade Report Data and Investment Instruction Data are transmitted to the trust banks on the real-time basis. (Fig.4 ⑤⑥) Trust banks then confirm the details of trade and send out Trade Report Affirmation Data. ("Affirmed" or "Disaffirmed") (Fig. 4 ⑦)Upon receipt of such data, PSMS transmits Notice Data of Trade Report Affirmation Status to the securities companies. (Fig. 4 ⑧) In case the status indicates "Disaffirmed" by the trust banks, securities companies (or/and investment managers) cancel Trade Report Data (or/and Investment Instruction Data) already sent and resend (corrected) Trade Report Data (or/and Investment Instruction Data). -

4

Generation of Settlement Instruction Data (Fig. 4 ⑨⑩)

When Trade Report Affirmation Data sent by the trust banks mentioned above item 3 carries "Affirmed" flag, the process moves to the next step, generation of Settlement Instruction Data. Generally speaking, settlement conditions such as safekeeping account number and cash account number are stable over transactions, and a Standing is pre-defined per a fund as a general condition. And PSMS provides Standing Settlement Instruction (SSI) database to register various settlement conditions for all trading parties. By use of this database, when the trade matching process completes, PSMS automatically generates Settlement Instruction Data, by attaching pre-registered settlement conditions to Trade Report Data/Investment Instruction Data as a base. (Fig. 4 ⑨) This generation of Settlement Instruction Data can be taken as a completion of the matching of settlement conditions, and PSMS thereafter transmits Notice of Settlement Matching Status Data with "Matched" status to both parties. (Fig. 4 ⑩) A series of processes above enables securities companies and trust banks as a settlement agent to eliminate manual efforts of creation and transmission of the Settlement Instruction Data and to realize faster and securer operations. -

5

Generation of DVP Order (Fig. 4 ⑪)

When settlement conditions in Settlement Instruction Data which indicates the linkage to Book-entry Transfer System and the DVP settlement are matched, and when both parties instruct PSMS that they can deliver securities and cash, PSMS prepares a DVP Order from the matched settlement instruction data of both deliverer and receiver immediately and transmits the order to the Book-entry Transfer System. (Fig. 4 ⑪)

3.Other Types of Matching Process than Tripartite Central Matching Type (Without Using Investment Instruction Distribution Service)

In addition to Tripartite Central Matching Type (Without Using Investment Instruction Distribution Service), PSMS supports six other service types, namely Tripartite Central Matching Type (Using Investment Instruction Distribution Service), Investment Instruction Support Unsubscribed Type, Through Type, Proper Type, Bilateral Central Matching Type, and Duplex Type.

-

1

Tripartite Central Matching Type (Using Investment Instruction Distribution Service)

In this type, PSMS does not receive Investment Instruction Data from the investment managers, but PSMS, on their behalf, generates Investment Instruction Data based on Trade Report Data sent from the securities companies and transmits the data to the investment managers. After checking the contents of the data, the investment managers send it back to PSMS as Investment Instruction Data. The investment managers enable to replace Notice of Execution by Fax, etc. from the securities companies by the electronic data transmission. -

2

Investment Instruction Support Unsubscribed Type

This type is for the case when investment managers do not participate in PSMS and send Investment Instruction Data (or Investment Instruction Statement) to trust banks by some other means. In this case, the trust banks receive only Trade Report Data sent by the securities companies via PSMS, match internally Trade Report Data with Investment Instruction Data (or Investment Instruction Statement) received by some other methods, and send Trade Report Affirmation Data to PSMS. -

3

Through Type

This type is for cases that PSMS is not used for matching Investment Instruction Data and Trade Report Data. The Investment Instruction Data sent from the investment managers and the Trade Report Data sent from the broker/dealers are transmitted to the trust banks respectively. Through Type is mainly used when investment trust management companies adopt the “specific identification method" for the valuation of bonds they own as assets of their investment trusts. In this case, the trust banks match Trade Report Data/Investment Instruction Data internally and send the Trade Report Affirmation Data to PSMS. -

4

Proper Type

This type is for the case when the buy-side consists of a single institutional investor such as life/non-life insurance companies or trust banks who perform investments and settlement for their own transactions. In this case, buy-side firms receive the Trade Report Data via PSMS which is sent from securities companies, match it with their internal data, and then send back Trade Report Affirmation Data to PSMS. As only a single party is involved in the transactions from trade to settlement, matching process becomes simpler than the case like specified money trust transactions, by eliminating the transmission/receipt of Investment Instruction Data.

Proper Type is also used to confirm the new issuing record information of convertible bonds and corporate bonds between underwriters and issuing agents. -

5

Bilateral Central Matching Type

This type is for cases that two parties confirm the result of an OTC trade like inter-broker trade, and both the seller and buyer send the Trade Report Data to PSMS respectively. PSMS executes matching of the Trade Report Data sent from the seller and the buyer and immediately transmits Notice Data of Trade Matching Status. -

6

Duplex Type

This type is for cases where a stock, etc. is issued and recorded and three parties in concern – underwriters, transfer agents, and cash correspondents – confirm the details of new issuing record information one another. When underwriters send New Issuing Record Information Data via PSMS, transfer agents and cash correspondents confirm it, and send back New Issuing Record Information Affirmation Data to PSMS in turn.

(2) Non-Residents' Transactions

1. Scope of Services (Ref. Fig. 5)

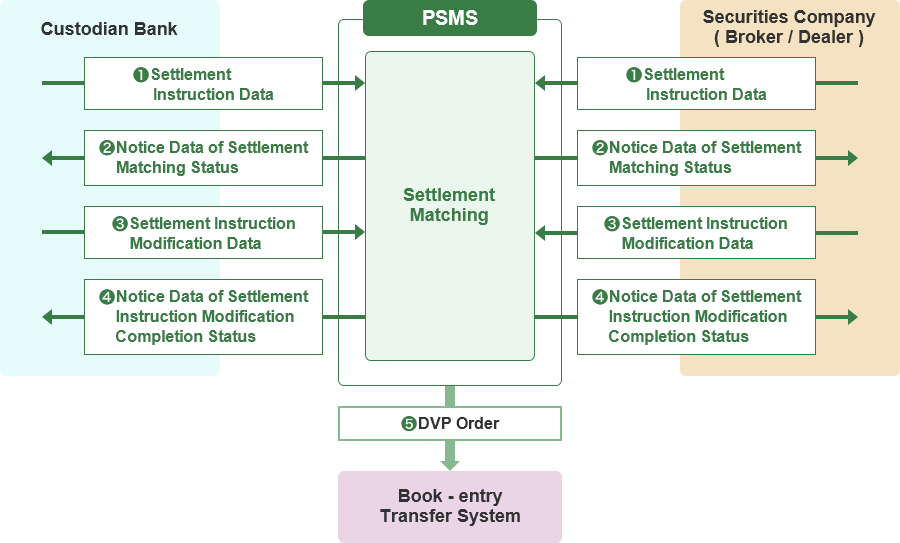

Fig. 5 Non-Residents' Transactions

In case of non-residents' transactions, PSMS does not perform Trade Matching, but utilize matching of Settlement Instruction Data sent from settlement agents such as banks and securities companies, who perform custody operations for Japanese securities traded by non-residents.

2. Outline of Matching Process

-

1

Transmission/Reception of Settlement Instruction Data/Notice Data of Settlement Matching Status Data (Fig. 5 ①②)

When Settlement Instruction Data are received from settlement agents such as banks and securities companies who perform custody operations (Fig. 5 ①), PSMS searches for the data to be matched in accordance with the matching logic. When the data to be matched are specified, the matching procedure for settlement details takes place and Notice Data of Settlement Matching Status are transmitted to both of the deliverer and receiver in the real-time with the matching status. (Fig. 5 ②) In the case of non-residents' transactions, there often arises a trivial gap of settlement amount between both settlement agents when they try to conduct settlement matching. If they must always match the amounts exactly, they would need to frequently confirm the details with overseas trading parties, thus making it difficult to realize smooth settlement process. In order to solve this issue, from January 2014 on, if the difference between both parties' amounts is equal to or less than 100 yen, PSMS will match the instructions, adopting the amount of securities deliverer to be processed thereafter. -

2

Transmission/Reception of Settlement Instruction Modification Data/Notice Data of Settlement Instruction Modification Completion Status (Fig. 5 ③④)

When settlement agents indicate, in Settlement Instruction Data transmitted as above item 1, that the securities or cash cannot yet be delivered, the settlement agents need to send the Settlement Instruction Modification Data, after checking the balance of securities or cash, which caused the delivery to be suspended, and making the delivery to be executable. (Fig. 5 ③) When the modification data are received, PSMS rewrites the status of Settlement Instruction Data already recorded and transmits the Settlement Instruction Modification Completion Status Data, with the modified status, to both deliverer and receiver. (Fig. 5 ④) -

3

Generation of DVP Order (Fig. 5 ⑤)

When settlement conditions in Settlement Instruction Data which indicates the linkage to Book-entry Transfer System and the DVP settlement are matched, and when both parties instruct PSMS that they can deliver securities and cash, PSMS generates a DVP order from the matched Settlement Instruction Data of both deliverer and receiver immediately and transmits the order to the Book-entry Transfer System. (Fig. 5 ⑤)

Pre-Settlement Matching System

Specific Enquiries about the System

General Enquiries about the Pre-Settlement Matching System