Background and aims

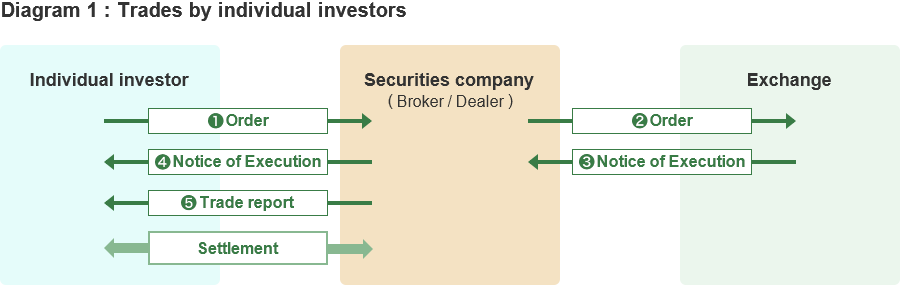

When individual investors invest in equities, they typically place an order themselves through a securities company. The equity and cash settlement processes are usually decided in advance between the investor and the securities company, and at few stages is there any requirement to complete hundreds or even thousands of orders in a single day. Accordingly, once a trade is executed and the investor receives a trade report, there is no need to reconcile the content and settlement conditions for each trade, and settlement can proceed according to the agreed conditions. (See chart 1)

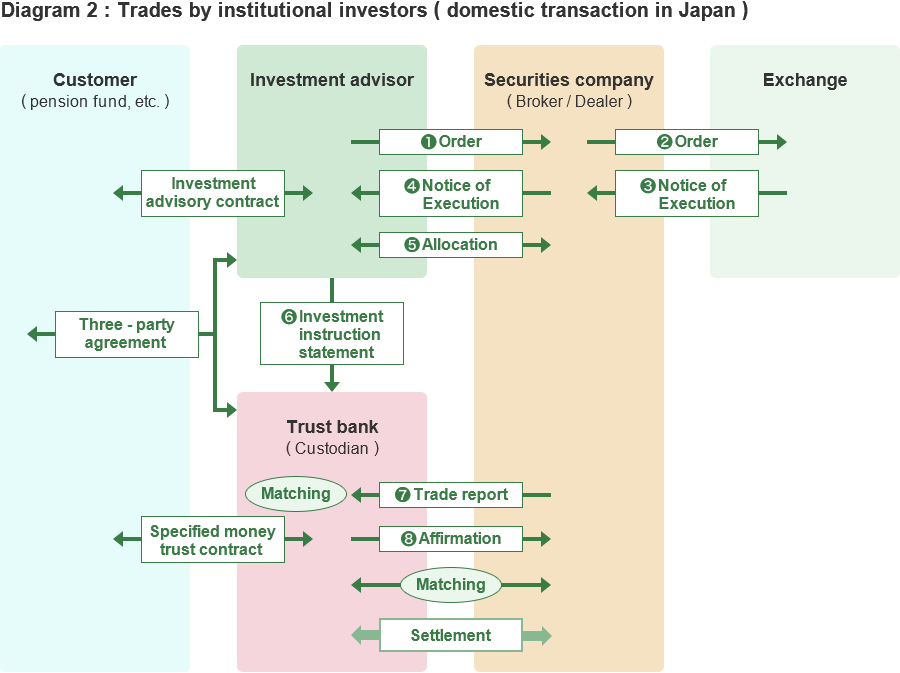

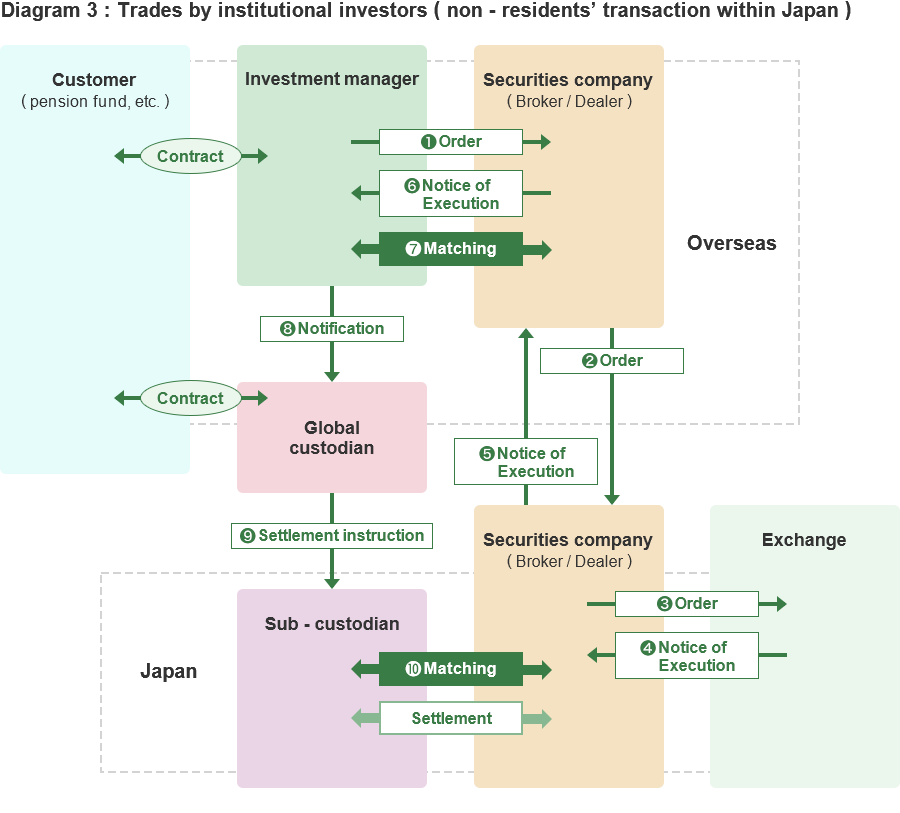

However, in the case of trades by institutional investors, investors' functions are segmented and complicated; it is rare that one person can handle a trade from order to settlement in the same manner as an individual investor, and the number of trades is far greater. This is shown in the following diagrams 2 and 3, using the example of trading by a pension fund.

Pension funds are managed and invested in various ways. One commonly used method of investing the fund's money is via a specified money trust. In a specified money trust, the customer (the pension fund) does not usually make investment decisions; instead, the fund entrusts its assets to a trust bank, and entrusts investment decisions of its asset to an investment advisory company. An investment advisory company may manage the assets of various pension funds, and will typically place an order with a securities company on behalf of multiple customers (pension funds) simultaneously. The securities company executes the order and then informs the investment advisory company of the results of the trade (Notice of Execution), whereupon the investment advisory company divides up (allocates) the executed portion of the trade among its customers' accounts (or funds).

When the securities company places the order with the exchange, the executed prices may split up. Since an amendment to the Ordinance of the Cabinet Office about securities companies was issued on July 2003, it is becoming general practice in Japan to report these trades by using the average price like in Europe and the U.S. However, this allocation process is still very complicated. In either case, when the allocation is completed, the securities company reports the trade results accordingly to the trust bank, where the pension fund assets are entrusted (Note: an issuance of trade report can be skipped in the case of trades by institutional investors.). Since the pension fund may not have entrusted all of their assets to the same trust bank, the trade result is reported to each trust bank involved. Next, the securities company and the trust banks confirm the details of trade and settlement for each fund. This step is known as "matching."

As such, settling trades by institutional investors necessitates a complex process for each trade in each fund. Until the launch of PSMS in Japan, however, almost all steps in this process had commonly been performed manually, involving faxes and telephone calls. Checking each step in this non-electronic system is inefficient and costly; moreover, there is the constant risk of human error.

PSMS started its operation just when it was required from the viewpoint of reducing settlement risk.

the G30 recommendations on securities settlement systems (1989) and the amended recommendations of the International Securities Services Association (ISSA) (1995) made nine proposals on ways to improve securities settlement systems. One of these was the use of Delivery Versus Payment (DVP), or "simultaneous, final, irrevocable and immediately available exchange of securities and cash on a continuous basis throughout the day." In the DVP settlement process, both the receiver and the deliverer of securities and cash send settlement instructions. If this set of two instructions does not match, the settlement is immediately nullified. This is why the pre-matching of settlement instruction data conducted in PSMS is so important.

There was another important step in the reduction of settlement risk: the shortening of the settlement cycle to T+1, meaning a trade will be settled on the next business day of the trade date (T). To achieve the T+1 settlement cycle, it is necessary to confirm, or to complete the matching process of the settlement instruction data on T+0, or the same day as the trade. Finishing it for large volume of transactions cannot be achieved manually.

Based on the points discussed above, it was becoming essential that PSMS was introduced into the Japanese securities market to systematize and automate the process of post-trade matching to raise trading efficiency and maintain international competitiveness.

-

*Straight Through Processing (STP): A system for securities trading in which all steps, from order to settlement, are conducted seamlessly and without manual intervention.

Pre-Settlement Matching System

Specific Enquiries about the System

General Enquiries about the Pre-Settlement Matching System