Example of new record service fees calculation (from April 3, 2006 onwards)

The issuer bears the cost of the administration of the information of the issue and administration of the balance of issue from the time of issuance until the time of redemption.

New record service fees = underwritten amount x 0.19bp (annualized rate) (1bp = 1/10000)

(However, there is a ¥ 100,000 cap which means that, in cases where the results of the above calculation for new record service fees exceed ¥ 100,000, the amount payable is held to a maximum of ¥ 100,000.

Example No.1

Q1. How is the new record service fee calculated in the case of the following company (Company A) issuing short-term corporate bonds under the terms shown?

Issuance details, No.1

| Issuer | Issue date | Redemption date | Total amount issued |

|---|---|---|---|

| Company A | April 1 | July 1 | ¥ 5 billion |

| Underwriters | Amounts underwritten | |

|---|---|---|

| 1 | Securities company A: Customer account | ¥ 500 million |

| 2 | Securities company A: Holding(Self) account | ¥ 1 billion |

| 3 | Bank B: Customer account | ¥ 1.5 billion |

| 4 | Bank B: Holding (Self) account | ¥ 2 billion |

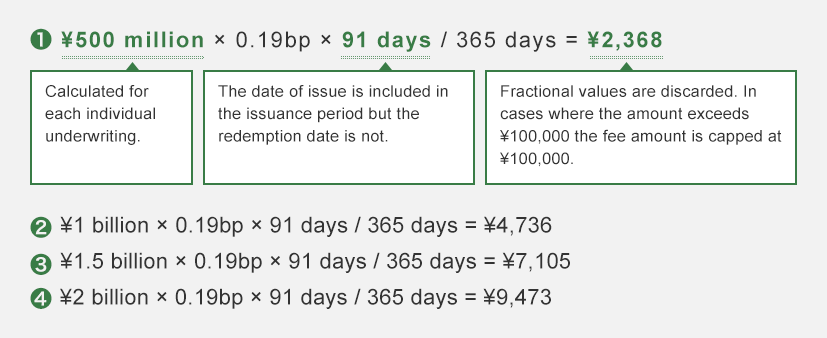

A1. Total new record service fee for Company A = ¥ 2,368 + ¥ 4,736 + ¥ 7,105 + ¥ 9,473 = ¥ 23,682

Calculation methodology for fees in example No.1

Example No.2

Q2. How is the new record service fee calculated in the case of the following company (Company B) issuing short-term corporate bonds under the terms shown?

Issuance details, No.2

| Issuer | Issue date | Redemption date | Total amount issued |

|---|---|---|---|

| Company B | April 1 | July 1 | ¥ 35 billion |

| Underwriters | Amounts underwritten | |

|---|---|---|

| 1 | Securities company A: Holding (Self) account | ¥ 25 billion |

| 2 | Securities company B: Customer account | ¥ 10 billion |

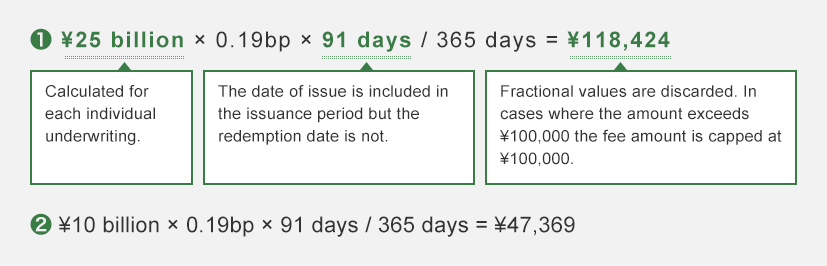

A2. Total new record service fee for Company B = ¥ 100,000 + ¥ 47,369 = ¥ 147,369

Calculation methodology for fees in example No.2

For enquiries about the Book-Entry Transfer System for CP, please contact:

General Enquiries about the Book-Entry Transfer System for Short-Term Corporate Bonds (CP)