Corporate Philosophy, etc.

The JASDEC Group (Japan Securities Depository Center, Inc., and JASDEC DVP Clearing Corporation) has formulated a corporate philosophy that expresses our fundamental approach to corporate activity within our organization and forms the basis for management planning and business execution by all directors and employees. Related policies established by the Group include a Basic Management Policy, a Basic Policy on Corporate Governance.

Corporate Philosophy

Recognizing our public role as a provider of important settlement service in the capital market, we are committed to constant reform from the point of view of users, aiming to provide reliable, convenient and highly efficient services that help improve capital market functions and contribute to the development of society.

Basic Management Policy

- 1Undertake user-oriented operational management from the point of view of investors, issuers, market intermediaries and other market participants.

-

2Keep business environment and structural changes in the capital market firmly in mind and provide a wide range of globally recognized best practice in settlement services at a reasonable price, by acting rapidly and proactively to reform operations as well as ensuring sufficient financial and human resources.

-

3Undertake continuous and stable operational management, emphasizing risk management from the standpoint of the importance of serving as a settlement infrastructure.

-

4Ensure active disclosure and undertake management with an emphasis on corporate governance based on the public nature of our operations.

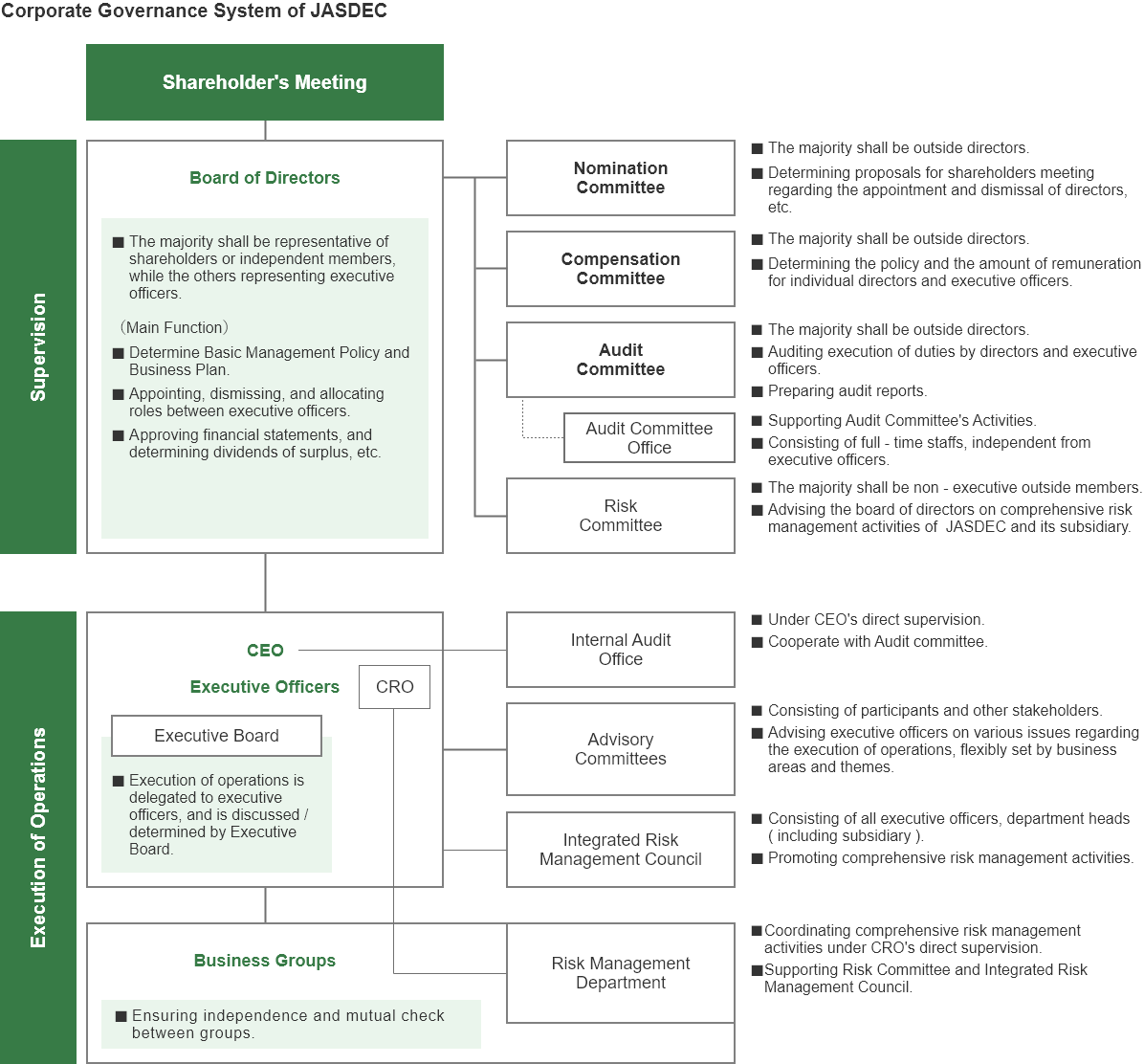

Basic Policy on Corporate Governance

Symbol

- DESIGN

- The symbol represents the people-to-people or informational "connection", and the asymmetrical shape emphasizes a more human and warm "connection" rather than a mechanical connection. In addition, the three circles represent investors (individual investors, institutional investors, etc.), issuers (business companies, etc.), market intermediaries (securities companies, banks, asset management companies, etc.) that support Japan's financial and capital markets together with us.

- COLORS

- The colors of the symbol, green and blue, are images of the ground and the sea, in other words, those of the earth, and express the desire to support sustainable growth.