Risk management through DVP settlement system for NETDs

JDCC has established various structures and maintained tight control of risk so that DVP settlement can be conducted securely through the DVP settlement system for NETDs

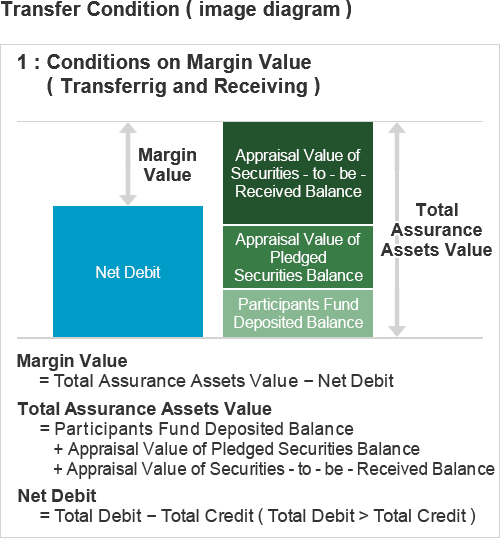

Risk management by means of Transfer Condition

JDCC applies the following three conditions (the general term we use to refer to these is ‘Transfer Condition’) whenever it assumes obligations in relation to individual transactions executed by DVP participants seeking to use of the DVP settlement system for NETDs

1. Assurance Assets (Margin Value) condition

JDCC seeks that the Assurance Assets (Margin Value) of each DVP participant go over his net debit. Assurance Assets consist of three elements: (1) Cash deposited with the JDCC by DVP participant (this is referred to as Participants Fund) ; (2) stocks, government bonds and other securities deposited with JDCC by DVP participant (this is referred to as Pledged Securities) ; and (3) stocks and other securities transferred to the JDCC account by means of the DVP settlement system for NETDs on the settlement day (this is referred to as Securities-to-be-Received). Among these assets, the assessed value of (2) Pledged Securities and (3) Securities-to-be-Received are calculated by multiplying the closing price on the business day prior to the settlement day by the appraisal rate (haircut).

By means of this methodology, even if a DVP participant were to default, all obligations of JDCC can be covered and paid out converting the Assurance Assets of the participant into cash, thus ensuring that payment can always be made.

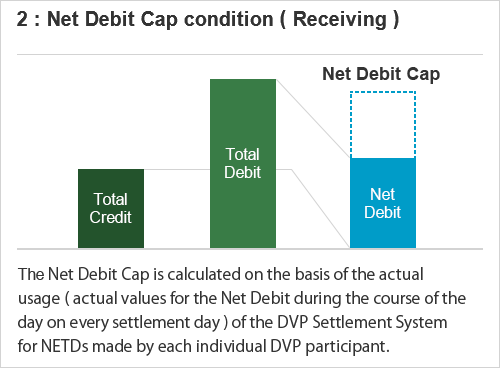

2.Net Debit Cap condition

The JDCC sets an upper limit (this upper limit is referred to as the Net Debit Cap) to the Net Debit that each individual DVP participant may have on the basis on an analysis of their own actual usage over a certain period. In addition, JDCC sets the Maximum Net Debit Cap so that the Net Debit Cap shall remain within a certain range. The Net Debit Cap controls the maximum amount of exposure to the DVP settlement system for NETDs that is available to the individual DVP participant with the aim of limiting the risk within the boundaries of the Commitment Assets that the JDCC has already provisioned for the purpose of covering risk.

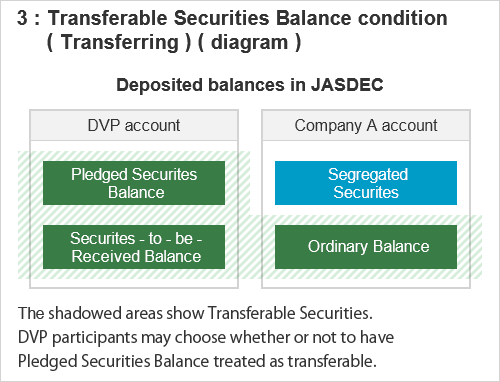

3.Transferable Securities Balance condition

In addition, the JDCC seeks that the transferring DVP participant has securities balance in excess of the volume of securities required for book-entry transfer by means of the DVP settlement system for NETDs.

Changes of risk management conditions

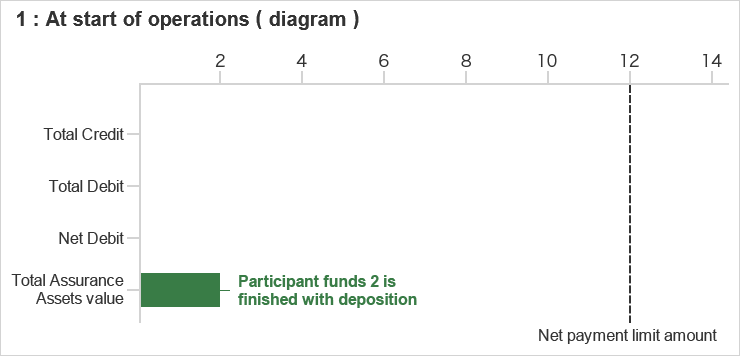

JDCC ensures that the abovementioned conditions laid down for the execution are enforced for individual transactions undertaken by DVP participants seeking to use the DVP settlement system for NETDs. Only when these conditions have been satisfied, JDCC will assume obligation related to the DVP settlement system for NETDs. Changes of the risk management conditions with the obligation assumption by the JDCC are as follows:

STEP1Company A has deposited participants fund 2 with the JDCC. At this stage no calculation of the value of the assets is made as there are no securities book-entry transfer at present.

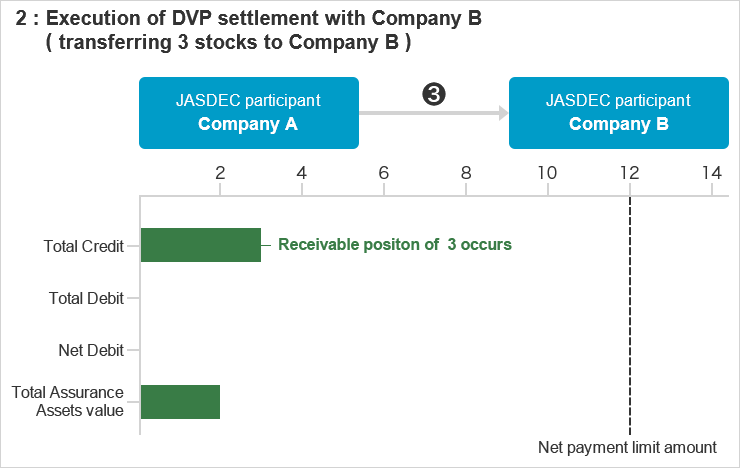

STEP2Stocks with settlement value 3 are transferred from Company A to Company B. Company A now has the right to receive settlement value 3 as consideration. (Total Credit of company A is booked as 3)

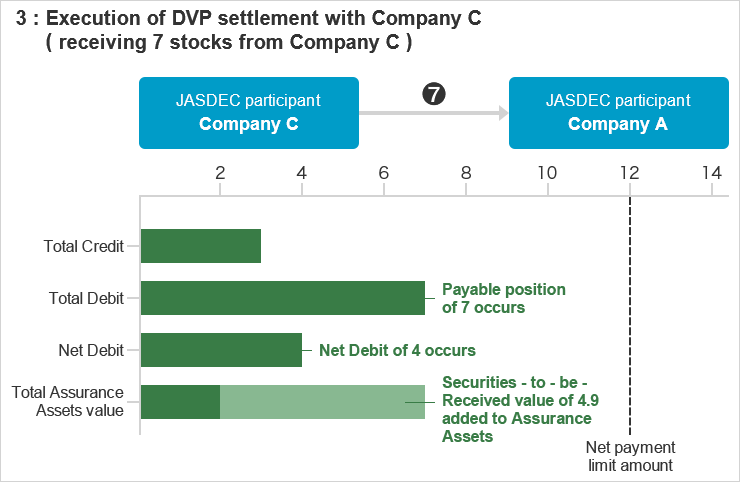

STEP37 stocks with settlement value 7 are transferred from Company C to Company A. Simultaneously total debit of company A is booked as 7 and Assurance Assets of company A are increased by 4.9(value applied appraisal rate 0.7 on the market value of Securities-to-be-Received).

Risk management on financial group basis

JDCC sets, in order to address defaults of DVP participants on a consolidated basis, an upper limit to the total amount of the Net Debit Caps of DVP participants belonging to the same financial group (DVP Participant Group).

Maintaining of Liquidity Resource

JDCC always maintains Liquidity Resource from Participants Fund and Bank Credit Line, even if DVP participants were to default, it would be able to complete fund settlement of the day up to the specified time with such resources.

JDCC maintains a scale of Liquidity Resource at a level twice as high as that required by the internationally recognized ‘Lamfalussy standards’ for settlement systems conducting netting operations. DVP settlement system for NETDs boasts such an extremely high level of stability that the fund settlement, in case where the two DVP participants with the maximum Net Debit or a DVP Participant Group were to default, would be able to be completed even with one of Commitment Line Banks' default.

Examination on the effectiveness of Assurance Assets and appraisal rate (haircut) by stress test and back test

JDCC requires Assurance Assets of each DVP participant to exceed its net debit as one of the conditions where JDCC assumes the obligation ("1. Assurance Assets condition" as abovementioned), and if a DVP participant defaults in payment, JDCC cashes out the defaulting participant's Assurance Assets to recover the Liquidity Resource which was used to cover the payment default.

Assurance Assets consist of Participants Fund, Pledged Securities and Securities-to-be-Received. Among these assets, the assessed value of Securities-to-be-Received and Pledged Securities are calculated by multiplying the closing price on the business day prior to the settlement day by the appraisal rate (haircut). This scheme allows JDCC to cover the risk of stock price decline which may happen when the defaulting participant's Assurance Assets are cashed out.

JDCC conducts a stress test on a daily basis to examine sufficiency of the Assurance Assets in extreme but plausible market conditions, as well as a back test to examine the effectiveness of appraisal rate (haircut) on Securities-to-be-Received and Pledged Securities. These test results are disclosed on this website every quarter as a quantitative data concomitant with the "Principles for financial market infrastructures".

To see a gross outline of the stress test and back test, please refer to the followings. *1

| Assessed value multiplied by the historically-biggest-declining ratio (A) 〈Stress test〉 |

= (the amount of Securities-to-be-Received and Pledged Securities)*(closing price on the business day prior to the settlement day)*(the appraisal rate (haircut) calculated per issue based on its biggest declining ratio since the implementation of the DVP settlement system for NETDs (also including Black Monday in 1987)) |

|---|---|

| Selling price (B) 〈Back test〉 |

= (the amount of Securities-to-be-Received and Pledged Securities)*(closing price on the business day following the settlement day) *2 |

| Assessed value with appraisal rate (haircut) (C) | = (the amount of Securities-to-be-Received and Pledged Securities)*(closing price on the business day prior to the settlement day)*(the appraisal rate (haircut)) |

-

*1JDCC conducts stress tests and back tests on the financial group basis as well as individual DVP participant basis.

-

*2In case of DVP participant's fund settlement default, JDCC cashes out the defaulting participant's Assurance Assets basically on the business day following the fund settlement default day.

- 〈Stress test〉

- Conducting the stress test, JDCC confirms : (A) ≧ (C)

Stress test results are used to confirm that the assessed value of each DVP participant's Assurance Assets (the total of cash value of Participant Fund and cash value of Securities-to-be-Received and Pledged Securities which is assessed based on the result of stress test.) doesn't fall below the net debit, which is the total fund paying amount minus the total receiving amount. - 〈Back tests〉

- Conducting the back test, JDCC confirms : (B) ≧ (C)

Execution of monitoring of DVP participants

JDCC monitors DVP Participants on an ongoing basis about the internal system for business operation and financial basis, etc. and thereby controls the impact that any changes to the credit or operational risk profiles of individual DVP participants may have on the DVP settlement system for NETDs.

For enquiries about the DVP settlement system for NETDs please contact:

General Enquiries about the DVP Settlement System for NETDs