Structure of Book-Entry Transfer System for Shares, etc. (book-entry shares)

The main mechanisms of the Book-Entry Transfer System for Shares, etc. are described below.

- Book-Entry Transfer System for Shares, etc.

- New registration procedure

- Book-entry transfer procedure

- Procedures for purchase or sale of shareholdings of less than one unit

- Procedure for partial cancellation of shares

- Procedures arising from corporate reorganization

- General Shareholder Notification

- Individual Shareholder Notification

- Requests to the Issuer for information

- Treatment of dividends

Book-Entry Transfer System for Shares, etc.

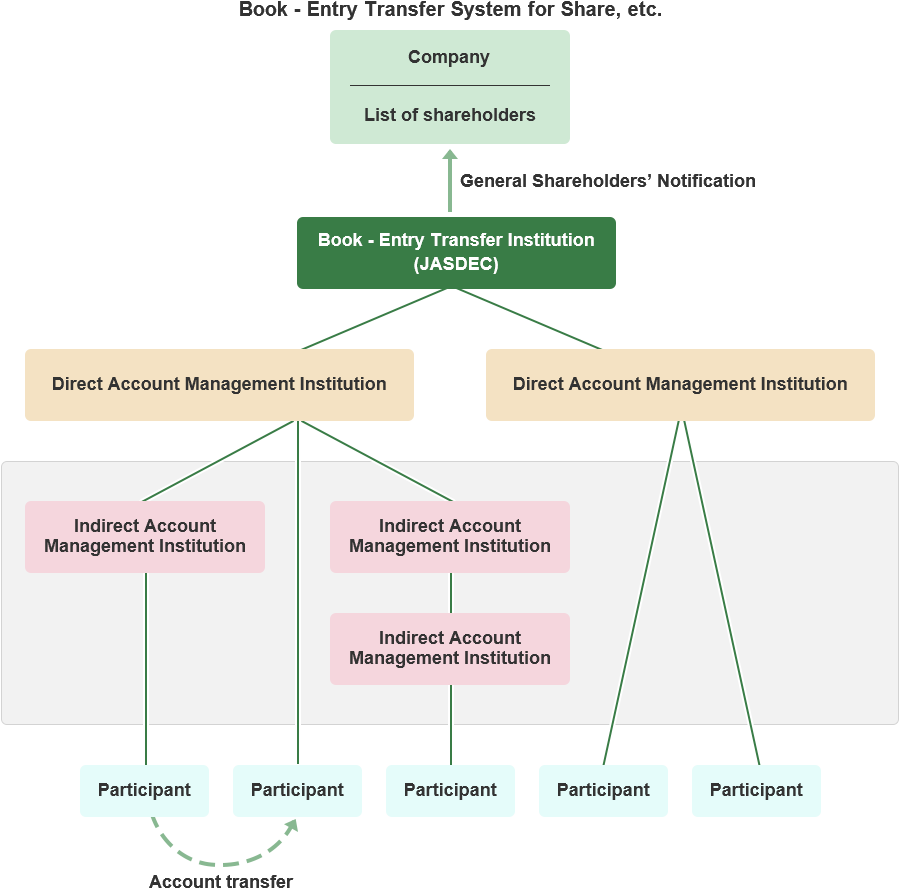

The Book-Entry Transfer System for Shares, etc. refers to the computerized management (issuance, transfer and cancellation) of shareholders' ownership rights (which had formerly been administered on the assumption of the physical existence of share certificates, etc.) through accounts established by JASDEC and securities companies, etc. in accordance with the Act on Book-Entry Transfer of Company Bonds, Shares, etc. which abolished share certificates, etc. for the shares, etc. of publicly listed companies.

Having obtained the consent of issuers to do so, JASDEC conducts transactions through this Book-Entry Transfer System for Shares, etc. in shares listed publicly on securities exchanges, warrants for new shares, corporate bonds with warrants for new shares, investment units, preferred shares, beneficial interests in investment trusts and other items pertaining to these instruments.

Advantage of Book-Entry Transfer System for Shares, etc.

Eliminate printing cost, stamp duty, cost for safekeeping and transfer,

Lower administrative cost for issuing and registration,

Remove the risks of forgeries, loss or robbery,

Reduce determination period of record date for shareholders,

Diversify the procedures to receive dividends,

and Promote more efficiency for securities settlements.

User relationship summary (example of book-entry transfer of shares)

〈System users〉(For book-entry transfer of shares)

- Issuer

- The issuer of the shares, etc. that JASDEC shall handle.

- Direct Account Management Institution

- Institutions for whom JASDEC opens accounts.

- Indirect Account Management Institution

- Institutions for whom accounts are opened by another Account Management Institution, and who open accounts for another party to enable the transfer of shares, etc., via the JASDEC system.

- Participant

- Those for whom JASDEC or an Account Management Institution have opened accounts to enable the book-entry transfer of shares, etc., via the JASDEC system.

〈System procedures〉(For book-entry transfer of shares)

An introduction to the main procedures in the Book-Entry Transfer System for Shares, etc.

New registration procedure

A new registration procedure is carried out when a company (the Issuer) issues a new listing on the stock exchange. The existing shareholders of the Issuer make a request (to securities companies, etc.) for intermediation of account notification so that the Issuer can receive information about the accounts it is to open to receive the share records already existing at securities companies, etc. The Issuer then makes a new record notification (to JASDEC), based on the account notification information it has received.

Book-entry transfer procedure

The transfer of the shares will not be valid unless the book-entry transfer application results in an increase in the number of shares recorded in the holding column of the account of the book-entry share receiver (transferee). The Participant whose number of shares recorded in their account is to be reduced as a result of the book-entry transfer (the transferer) shall apply to its upper-positioned Account Management Institution (the Account Management Institution who opened the Participant's account) for the book-entry transfer of the shares.

Procedures for purchase or sale of shareholdings of less than one unit

A Participant may request an Account Management Institution to arrange for the purchase of the Participant's shareholding of less than one unit that is recorded in the Participant's account (this request will be accompanied by a request for a book-entry transfer of the shareholding of less than one unit to the account of the Issuer). Conversely, a Participant may request an Account Management Institution to arrange for the sale to the Participant of an Issuer's shareholding of less than one unit of shares of a type already recorded in the Participant's account (if the Issuer has adopted a system for the sale of shareholdings of less than one unit).

Procedure for partial cancellation of shares

When the Issuer wishes to cancel some of its treasury shares, it shall carry out a procedure for the partial cancellation of the record of treasury shares recorded in the Issuer's account.

Procedures arising from corporate reorganization

For example, in the case of a merger where the shares of both the surviving company and the expiring company are listed, and where the shareholders of the expiring company are to be allotted book-entry shares in the surviving company as compensation, JASDEC notifies the Account Management Institutions about the merger. On the day that the merger takes effect, the Account Management Institutions record, in the accounts all shareholders of the expiring company, shares in the surviving company (the numbers of which are equivalent to the number of shares held in the expiring company multiplied by an allotment ratio) and erase the expiring company's shares.

General Shareholder Notification

Based on Article 151 of the Law Concerning Book-Entry Transfer of Company Bonds, Shares, etc., (the Transfer Law) the Book-Entry Transfer Institution makes General Shareholder Notifications by notifying the Issuer of the records of the Transfer Account Book as of the date of settlement. To endure that this notification occurs smoothly and correctly, the Book-Entry Transfer System for Shares, etc., requires in principle that all reporting from Account Management Institutions to the Book-Entry Transfer Institution and all notifications from the Book-Entry Transfer Institution to the Issuer be handled via computer. The Book-Entry Transfer Institution prepares for the General Shareholder Notification and other notifications by receiving lists of Account Management Institution participants' names and titles, and other necessary information in advance from the Account Management Institutions, and carries out participant name checking and other necessary management functions.

Individual Shareholder Notification

Based on Article 154 of the Transfer Law, the Book-Entry Transfer Institution makes Individual Shareholder Notifications by notifying the Issuer of the records in the Transfer Account Book of participants who are attempting to exercise their minority shareholder rights, etc. Participants who attempt to exercise their minority shareholder rights may request (via their Account Management Institution) the Book-Entry Transfer Institution to make an Individual Shareholder Notification to the Issuer on their behalf.

Requests to the Issuer for information

Within the Book-Entry Transfer System for Shares, etc., it is possible to apply for documents verifying the records of the Transfer Account Book or other information about these records. Participants themselves, or the Issuer or other individuals who have a material interest in the participant's account, may, if they have a valid reason to obtain the information, pay the required fees to the participant's upper-positioned Account Management Institution and request the Institution to supply the information.

Treatment of dividends

- Method using accounts registered to receive dividend payments

- In this method, the participant notifies the Account Management Institution of the details of a single account at a financial institution. The Account Management Institution notifies the Book-Entry Transfer Institution, which in turn during a General Shareholder Notification notifies the Issuer of the name of the account holder so that the shareholder can receive all types of dividend payments into the one account.

- Method for handling proportional allotments of dividends

- The participant delegates the receipt of dividend payments to the Account Management Institution in advance so that the Account Management Institution can collect the dividend payments on behalf of the participant.

- Simple agency

- In this method, the participant notifies the Account Management Institution in advance of the details of individually named accounts at financial institutions, set up to receive dividend payments. The Book-Entry Transfer Institution notifies the Issuer of the details of these accounts so that the shareholder can receive dividend payments into each of the individually named accounts that they have specified.